When the kids leave home, it marks the start of a whole new chapter—a quieter house, less laundry, and the freedom to make plans without working around school schedules or extracurricular activities.

Beyond the emotional shift, this change also brings a financial opportunity: without the daily costs of raising children, you can redirect your spending toward building a more robust savings plan for the years ahead. According to a 2022 report by the U.S. Department of Agriculture, the average cost of raising a child to age 18 is over $310,000. For empty nesters, this means a significant portion of the family budget can now be reinvested in personal goals, retirement, and even some new adventures.

This newfound financial flexibility makes it an ideal time to focus on boosting your savings. Whether it’s by cutting down on now unnecessary expenses, taking advantage of tax benefits, or reassessing your insurance needs, there are plenty of ways to increase your savings without drastically altering your lifestyle. Here are ten practical strategies to help you maximize this phase of life, empowering you to build security and financial freedom for the years ahead.

Reassess and Adjust Your Monthly Budget

What areas of your budget can you revise now that your household is smaller?

With fewer people at home, many of your monthly expenses can be trimmed down, freeing up extra cash that can go straight into savings. Groceries, for example, are one area where empty nesters often see immediate savings. The USDA estimates that a family of four spends about $1,000 per month on groceries with a moderate food plan, compared to around $600 for two people. By planning meals carefully and shopping with a smaller household in mind, you could save $400 or more each month, adding up to nearly $5,000 annually.

Other budget areas that are worth a second look include utilities, transportation, and entertainment. With less demand for heating, cooling, and water, utility bills can drop by a notable amount each month. Additionally, if you have fewer family outings or trips to attend kids’ events, both your entertainment and transportation costs are likely to go down. By assessing your adjusted needs and aligning your budget to fit this new stage of life, you’ll likely uncover hundreds of dollars in potential monthly savings—money that can be redirected toward retirement or other financial goals.

Cut Unnecessary Subscriptions and Expenses

Are there subscriptions or services that no longer serve you?

When the kids are out of the house, it’s a great time to take stock of all those recurring expenses that may have crept into your budget over the years. Subscriptions and memberships—such as streaming services, meal kits, gym fees, or even app subscriptions—can quietly drain hundreds or even thousands from your budget annually. A recent study by West Monroe found that the average American spends $273 a month on subscription services, and many people underestimate this amount by over 200%.

Start by listing all your recurring charges, then consider whether each one still provides value. Do you still need three streaming services? Is that gym membership being used, or could it be swapped for a home workout? By cutting just a few subscriptions, you could easily save an extra $50–$100 a month, or up to $1,200 annually.

To simplify the process, consider using tracking tools like Truebill or Mint, which can automatically scan for recurring charges and even help cancel unused subscriptions on your behalf. Small adjustments like these can quickly add up, allowing you to funnel those funds into your savings and start building a stronger financial foundation.

Downsize Your Home to Fit Your New Lifestyle

Could moving to a smaller home improve your financial situation?

With the kids out of the house, that once-busy home may start to feel more like excess space than a necessity. Downsizing can be a financially savvy move, offering substantial savings and reducing the time and energy spent on home upkeep. On average, moving to a smaller home can cut housing expenses by as much as 25–30%, according to data from AARP, translating to thousands of dollars saved annually on mortgage payments, property taxes, and utilities.

Beyond the monthly budget impact, downsizing can offer a simpler lifestyle with less cleaning, maintenance, and yard work. A smaller property can mean fewer responsibilities, allowing more time and resources for travel, hobbies, or simply enjoying life without the demands of a large home.

For many empty nesters, the financial gains are compelling. Zillow reports that the average homeowner who downsizes can save between $100,000 and $200,000 throughout a mortgage. This significant sum could boost retirement accounts, help eliminate any remaining debt, or allow for new investment opportunities. Downsizing isn’t just about saving money—it’s about creating a living situation that supports your goals and priorities for the years ahead.

If You Don’t Want To Downside, Monetize Your Empty Nest Space

Could you turn extra space into income?

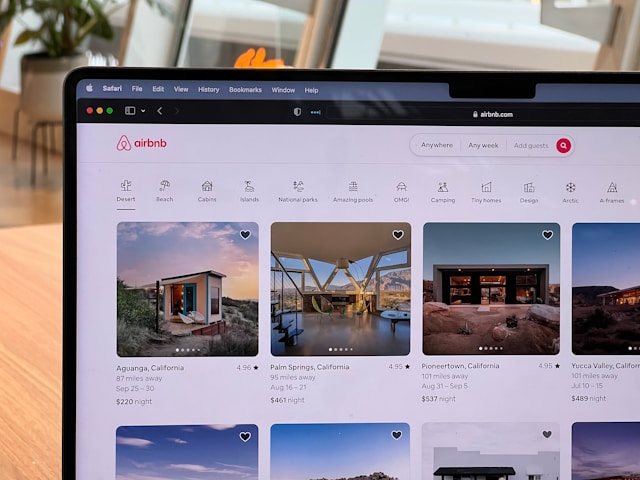

If downsizing doesn’t feel right, you can still make your empty nest work for you financially by monetizing that unused space. Many homeowners are finding creative ways to generate income from spare rooms, basements, or even extra parking spaces. For instance, renting a room through platforms like Airbnb or Vrbo can bring in hundreds or even thousands of dollars a month, depending on your location and the amenities you offer. According to Airbnb data, the average U.S. host earned over $13,800 in 2021—a potential boon for boosting your savings.

Beyond short-term rentals, there are other ways to convert unused space into cash. If your area allows it, consider renting storage space in your garage or basement for neighbors or local businesses needing extra storage. Alternatively, if you have a suitable setup, you could rent a room as a home office for remote workers who need a quiet space outside of their own homes.

These income-generating ideas allow you to maintain your home while putting your extra space to good use, turning an empty room into a reliable source of extra cash.

Also Read: The 10 Airbnb Questions Travel Pros Always Ask (That You Should Ask Too)

Reassess Your Insurance Needs

Are you still paying for insurance that covers more than you need?

With a smaller household, your insurance needs may have changed, and adjusting your coverage can be an effective way to cut costs. For instance, if your children are now financially independent, removing them from your auto insurance policy can lower premiums. According to insurance industry data, removing an adult child from a family auto policy can reduce rates by an average of 10–15%, potentially saving several hundred dollars annually, depending on your provider and location.

Health insurance is another area worth reevaluating. If you no longer need a family plan, switching to an individual or couple’s plan could lower premiums. Similarly, your life insurance needs may have decreased now that you’re not supporting dependents. You may consider reducing your coverage amount or shifting to a more affordable term policy, which can be significantly less expensive than whole life insurance.

Taking the time to review and adjust your insurance policies can yield meaningful savings each year, freeing up funds for retirement contributions, investments, or other financial goals.

Assess and Eliminate Debt (Where Possible)

What debts can you focus on clearing to free up more money?

As an empty nester, eliminating debt can be one of the most powerful steps you take toward financial freedom. By focusing on high-interest debts, such as credit card balances or personal loans, you’ll reduce your financial burden and free up cash flow for savings or other goals. Credit card debt, with average interest rates over 20% as of 2023, can quickly erode your financial health, so tackling it first often makes the most impact.

Two popular debt repayment strategies can help you pay down debt effectively: the snowball method and the avalanche method. The snowball method involves paying off your smallest debts first to build momentum, which can be motivating as you see balances disappear. The avalanche method, on the other hand, targets debts with the highest interest rates first, helping you save the most on interest costs over time.

For empty nesters who are close to retirement, it can also make sense to look into paying down or paying off mortgage debt if you have the means. Reducing or eliminating your mortgage payments can lower your monthly expenses significantly, providing more flexibility as you approach retirement. Whichever approach you choose, eliminating debt can be a freeing and financially sound move that allows you to focus more fully on long-term savings and security.

Automate Your Savings

Are you setting aside money without even thinking about it?

One of the easiest ways to build savings is to put it on autopilot. I found that setting up automatic transfers to a savings account made a world of difference. Now, every month, a little chunk of money flows straight into my high-yield savings account before I even see it—no need to think about it, no temptation to spend it.

Automatic transfers are also great for investment accounts, whether it’s an IRA, Roth IRA, or even a brokerage account. These small, steady deposits add up over time. For example, if you set aside $500 monthly in an account earning 4% interest, that’s over $6,000 a year saved, plus the growth from compound interest. And if you’re looking to build retirement funds, automating contributions means you’re consistently growing that nest egg without the hassle.

By putting your savings on autopilot, you make it a habit—effortless and stress-free. This “set it and forget it” approach has been a game-changer for me, and it’s one of the simplest ways to make sure you’re consistently building toward your financial goals.

Max Out Your Retirement Contributions

Are you taking advantage of retirement account contribution limits?

As you approach retirement, maximizing your retirement contributions can make a significant difference in your financial security. For those 50 and older, the IRS allows “catch-up” contributions, giving you an extra boost to build retirement savings in the years leading up to retirement. In 2024, for example, you can contribute up to $30,000 to a 401(k) (including a $7,500 catch-up contribution) and up to $7,500 to an IRA (with a $1,000 catch-up).

The impact of maxing out these contributions over even a short period can be substantial. For instance, if you contribute a maximum of $30,000 annually to your 401(k) for five years with an average 7% return, you would accumulate over $175,000—before accounting for any employer match. Similarly, maxing out an IRA with the catch-up contribution for the same period can add over $45,000 to your retirement savings.

Taking full advantage of these increased contribution limits means more tax-deferred or tax-free growth, allowing your funds to compound and giving you a stronger foundation for retirement. This strategy is especially valuable during the empty nest phase, when you may have fewer financial obligations and more flexibility to prioritize your future.

Take Advantage of Tax Benefits

Are you making the most of tax deductions and credits available to you?

There are a couple of excellent tax benefits to help boost savings. One is the Retirement Savings Contributions Credit (often called the Saver’s Credit). This gives a tax credit of up to $1,000 (or $2,000 for couples) based on what you contribute to a retirement account like an IRA or 401(k). This credit lowers your tax bill, effectively giving you a “bonus” for saving for retirement!

Another tax perk is the deduction for Health Savings Account (HSA) contributions. If you’re on a high-deductible health plan, you can set aside pre-tax dollars into an HSA, reducing your taxable income and building up a fund for future medical expenses. If you’re over 55, there’s an extra catch-up contribution of $1,000 allowed for HSAs.

Many states also offer tax benefits for people over 50, from property tax relief to retirement income exclusions. For us, these deductions have translated to real savings, leaving us with more funds for plans rather than sending it to Uncle Sam.

Explore Investment Opportunities

Could you reallocate savings to grow your wealth over time?

As you find more room in your budget, consider exploring investment opportunities that can make your savings work harder. Start by looking at options with different risk levels – but only put into such investments money you are willing to risk. For example, bonds offer stable returns, while dividend stocks can provide regular income and some stock growth, making them a great balance of income and investment.

If you’re open to it, a more hands-on approach like an actively managed portfolio can potentially offer higher returns. This will allow you or your advisor to adjust investments based on current market conditions. This could include specialized mutual funds or ETFs that align with specific goals, such as low-risk growth or income-focused investments.

Always remember to discuss your finances with an advisor. They can help you determine the right investment mix based on your risk tolerance, timeline, and goals. This ensures your portfolio matches where you are in life. By working with an advisor, you can have a tailored approach to your new financial life and avoid unnecessary risks.

By exploring and making strategic investments, you can continue to build wealth, creating a solid financial foundation for retirement and beyond.

Read Next: How to Choose a 529 Plan for Your Family